Financial Accounting and Reporting in Malaysia, Volume 2 (7th Edition) Tan Liong Tong 9789670853888

- Regular price

- RM 150.00

- Sale price

- RM 150.00

- Regular price

-

RM 0.00

Share

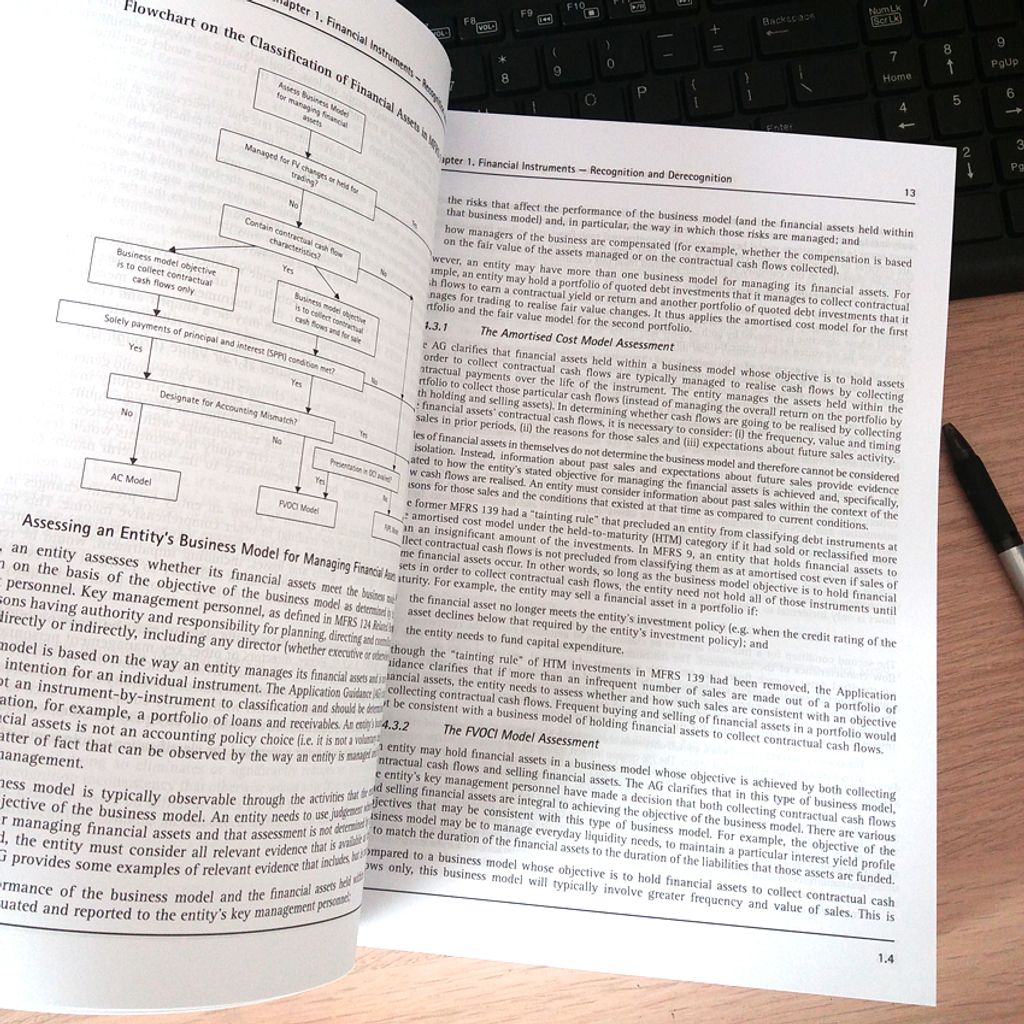

Financial Accounting and Reporting in Malaysia explains clearly the Conceptual Framework used in the preparation of financial statements for entities, including groups of companies, and how to analyse and interpret those financial statements. With a clear emphasis on local practices, accounting principles are discussed in detail to guide users on the preparation and presentation of financial statements to ensure compliance with the latest accounting pronouncements. Where applicable, comparisons are also made with statutory requirements and guidelines issued by the Securities Commission and the Central Bank of Malaysia. In addition, focus is given to providing sample comprehensive disclosures of the MFRSs that may serve as guidelines for company practices. Principles and issues are summarised, explained and demonstrated with illustrative questions and answers in each accounting chapter of this issues-based book.

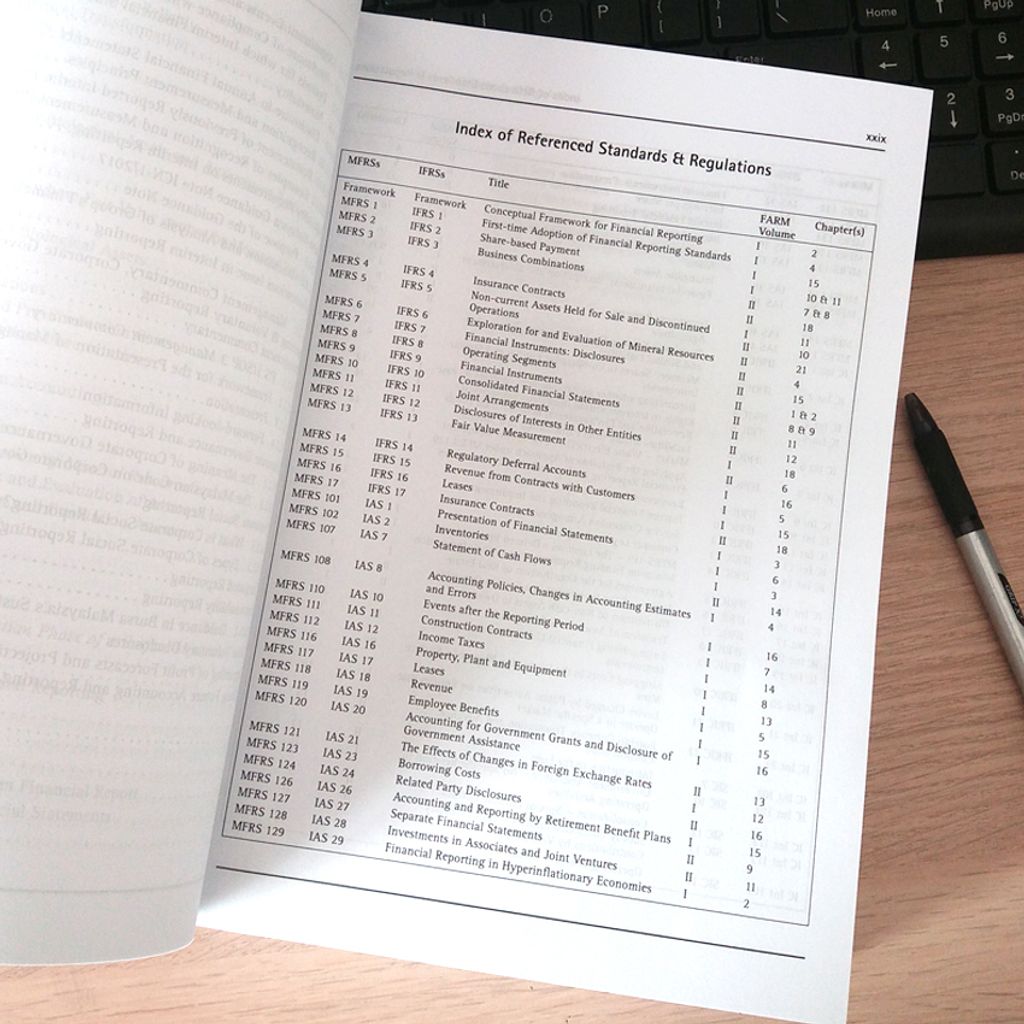

Topic Covered

Financial Instruments - Recognition and Derecognition

Financial Instruments – Measurement and Reclassification

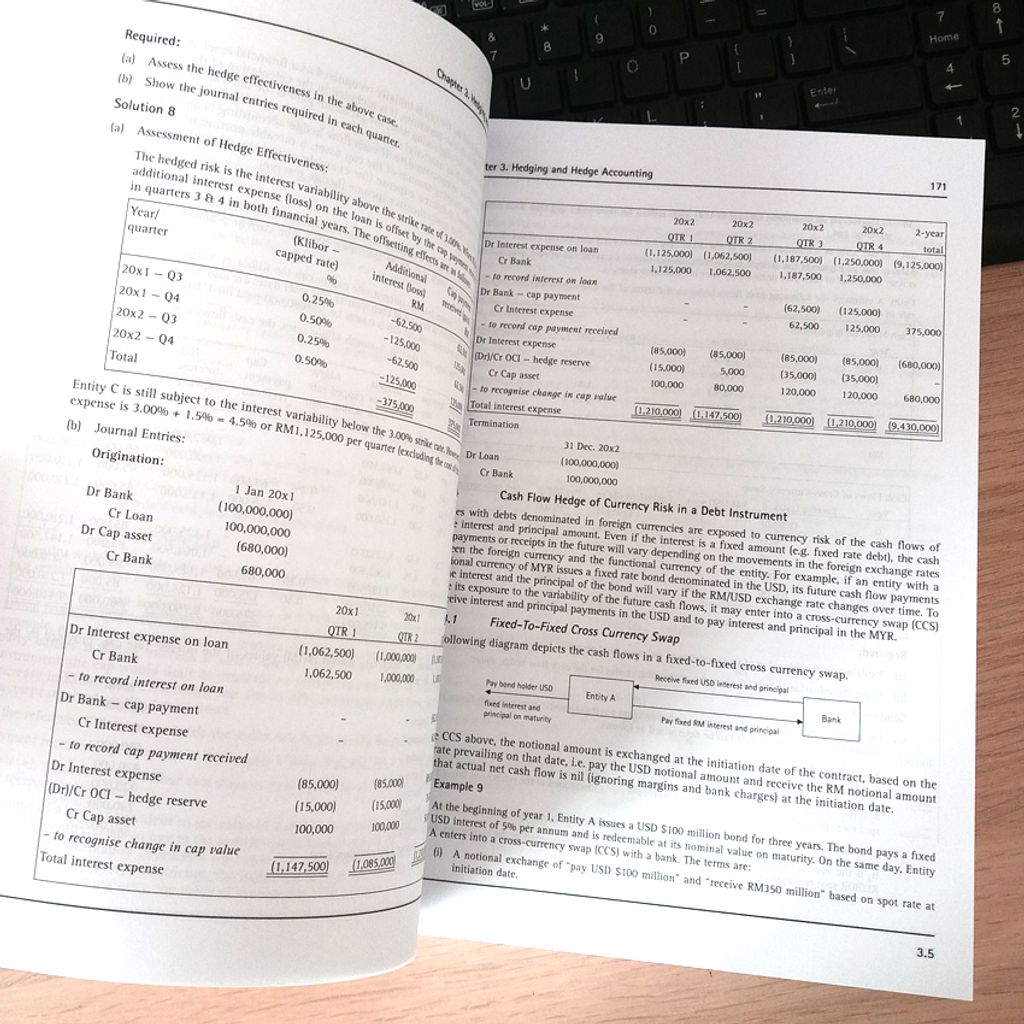

Hedging and Hedge Accounting

Financial Instruments - Presentation & Disclosures

Earnings Per Share

Mergers, Share and Business Valuation

Business Combinations

Reverse Acquisitions, Mergers & Combined Financial Statements

Consolidated and Separate Financial Statements

Advanced Consolidation Principles

Joint Arrangements and Associates

Disclosures of Interests in Other Entities

The Effects of Changes in Foreign Exchange Rates

Consolidated Statement of Cash Flows

Segment Reporting

Related Party Disclosures

Banks and Similar Financial Institutions

Insurance Entities

Investment Trust Funds

Agriculture Entities

Extractive Industries

Interim Reporting

Management Commentary, Corporate Governance, Sustainability Reporting & Social and Voluntary Reporting

Powered by Froala Editor