Malaysian Taxation: Principles & Practice, 28th Edition (2022) 9789672289081 By Chong Kwai Fatt

- Regular price

- RM 180.00

- Sale price

- RM 180.00

- Regular price

-

RM 0.00

Share

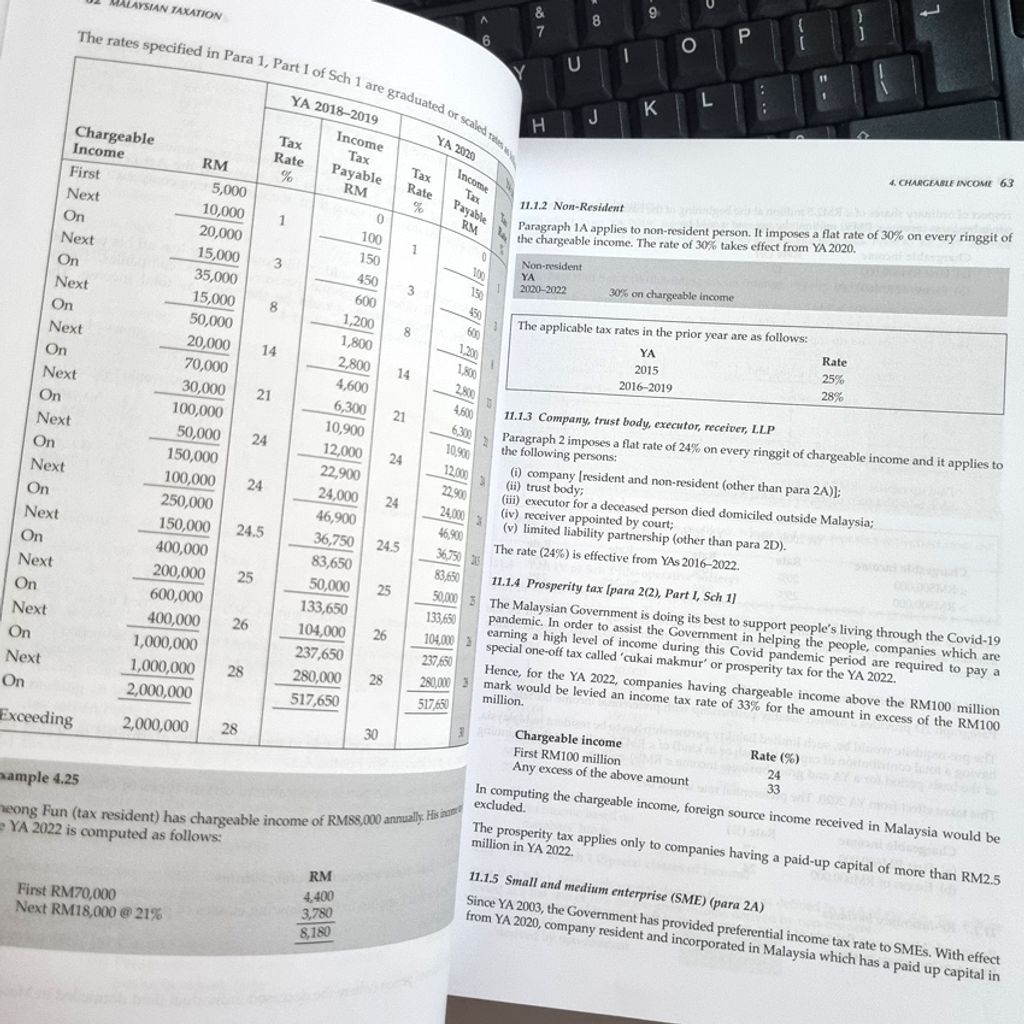

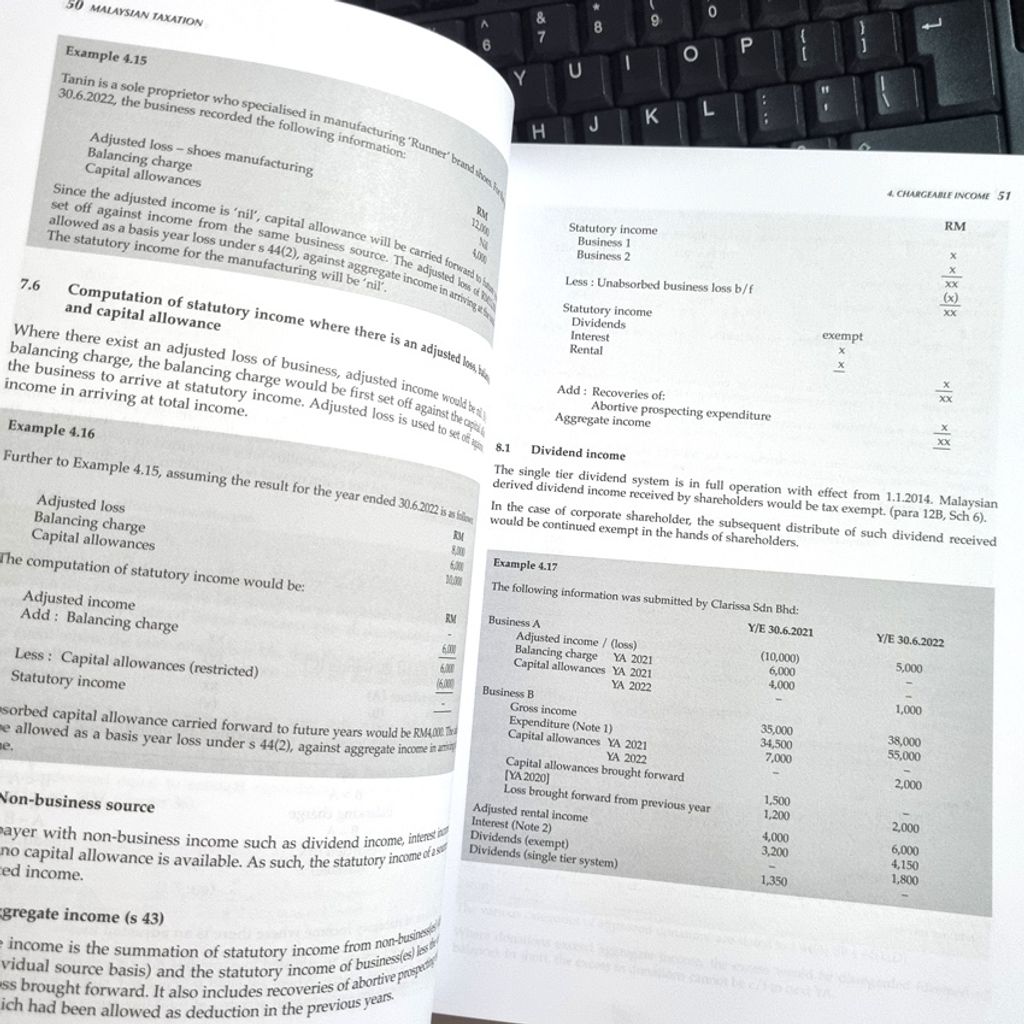

“Malaysian Taxation – Principles and Practice (2022, 28th Ed.)” covers a wide spectrum of income taxation, real property gains tax, sales tax and service tax in Malaysia. It has been published annually since 1994. The conceptual framework of income tax substantially involves business income, employment income, investment income, the deductions of business expenses and the claim of capital allowance, industrial building allowance, agriculture allowance, and forest allowance. Personal taxation with the deduction of tax relief, company taxation and partnership taxation are all carefully explained with practical applications and illustrations of tax computations.

Tax administration covers tax return and assessment, self assessment, appeal, penalties and offences, collection and recovery. Sales tax, service tax, and real property gains tax are included to make this text reference comprehensive, complete and practical.

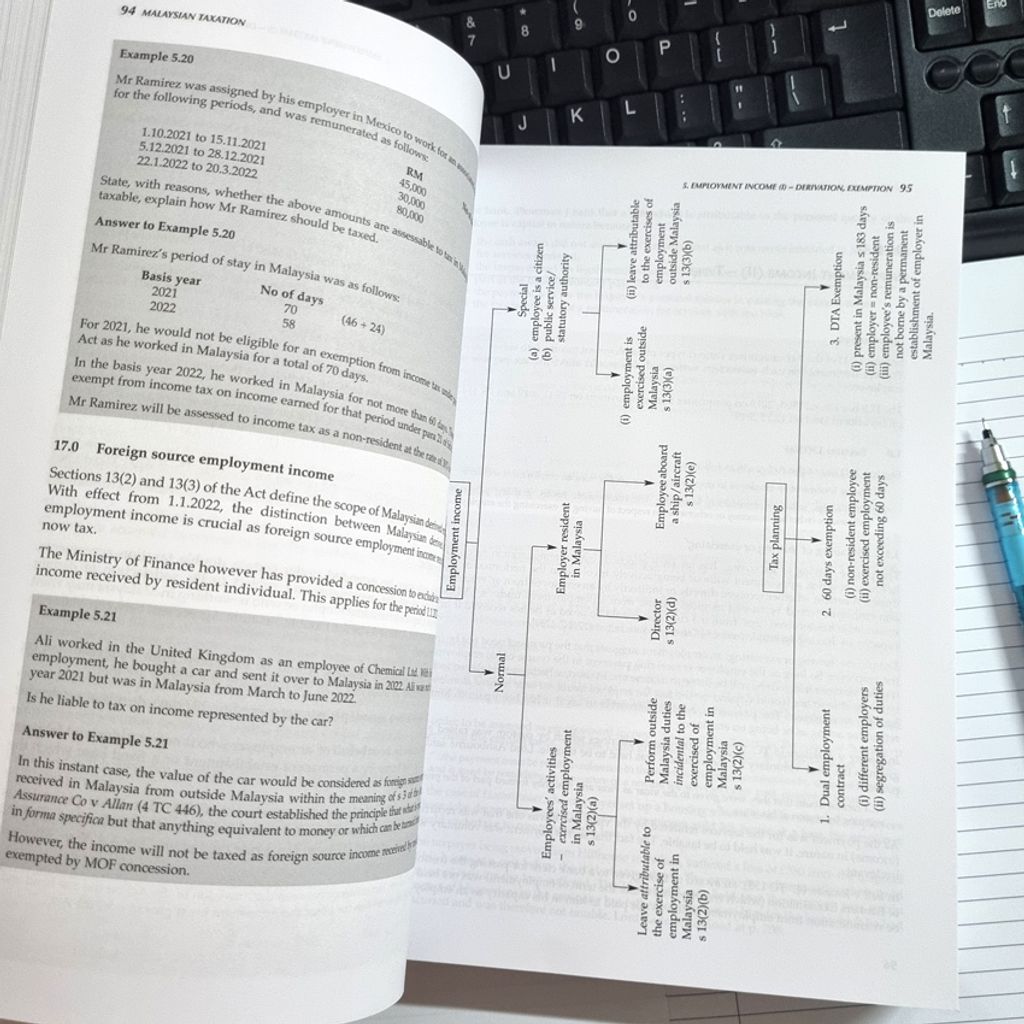

This reference text has been comprehensively revised and updated with the Finance Act 2021, PU(A) orders, Public Rulings, IRB guidelines and practice notes. A total of 503 examples, 29 flowcharts and 41 tables are used over 38 chapters to illustrate the law and practice on income tax, real property gains tax, service tax and sales tax.

This reference is an essential authoritative text for tax practitioners, accountants, auditors, group accountants, financial controllers, finance managers, business strategists, legal counsels, company directors, university academics, tax researchers, students pursuing accounting and business degree and professional examinations.

Powered by Froala Editor