Advanced Malaysian Taxation: Principles and Practice, 23E (2022) 9789672289074 By Choong Kwai Fatt

- Regular price

- RM 220.00

- Sale price

- RM 220.00

- Regular price

-

RM 0.00

Share

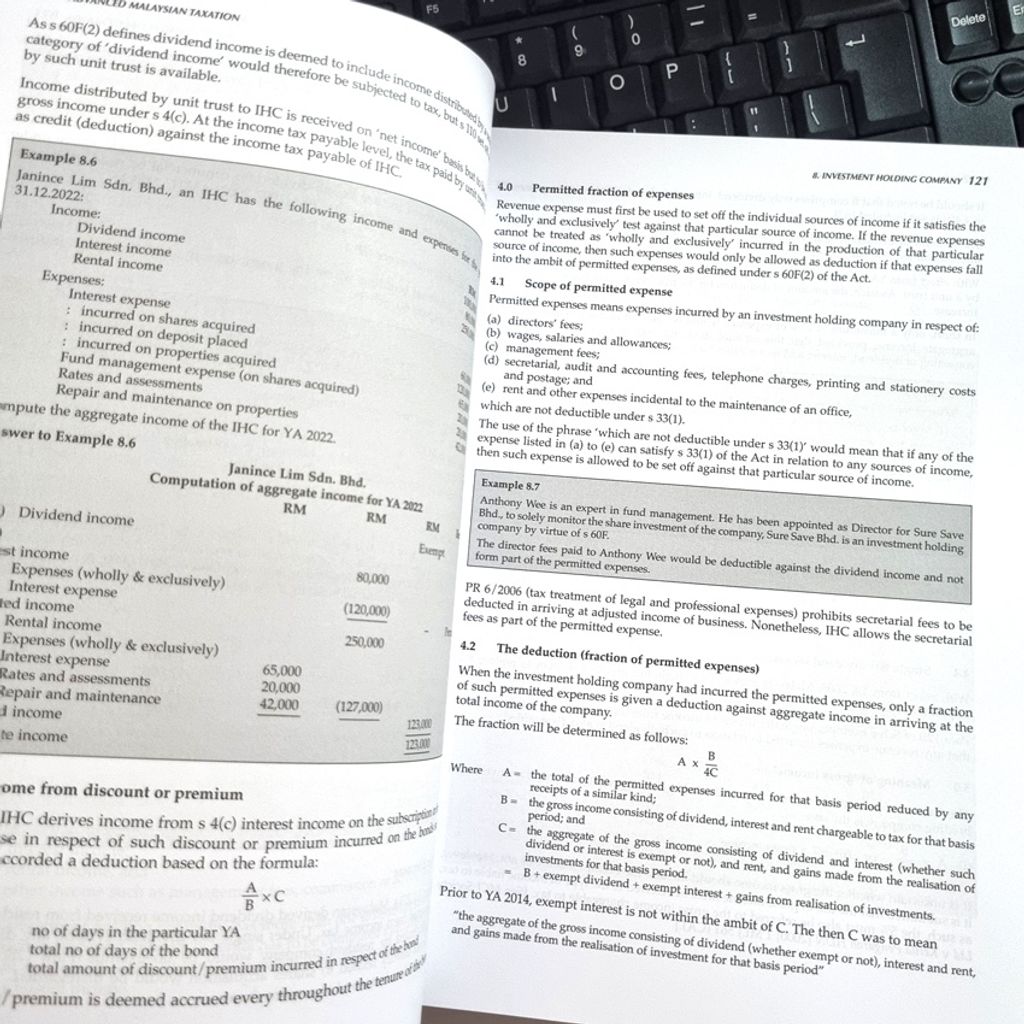

Advanced Malaysian Taxation – Principles and Practice (23rd Edition, 2022) covers the contentious tax issues and advanced aspects of income tax, real property gains tax, promotion of investments, stamp duty, and Labuan taxation. The conceptual legal frameworks, together with their practical applications, are systematically and carefully explained over 51 chapters with a total of 315 working examples, 27 flowcharts and 59 tables.

This reference text focuses primarily on income taxation, incorporating the Finance Act 2021, PU(A) orders, IRB public rulings, and practices and developments in 2021 and 2022. Each chapter analyses the legislation, highlighting the evolving legal principles, together with the tax computation, making this work a complete tax reference.

Tax practitioners are able to abreast with these latest tax changes and developments and fine hone their tax skills, enabling them to critically evaluate the tax issues and judiciously apply the relevant tax principles in tax works. Students too would be able to learn and acquire essential tax skills with the guidance of the many practical examples, flowcharts and tables that facilitate understanding and quick uptake of the tax principles.

This book is an indispensable text reference for tax advisors and consultants, tax agents, auditors, group accountants, financial controllers, finance managers, business strategists, legal practitioners, directors of companies, university academics, tax researchers, university students and students sitting for professional examinations.

The law is stated as at 1 April 2022.

Powered by Froala Editor