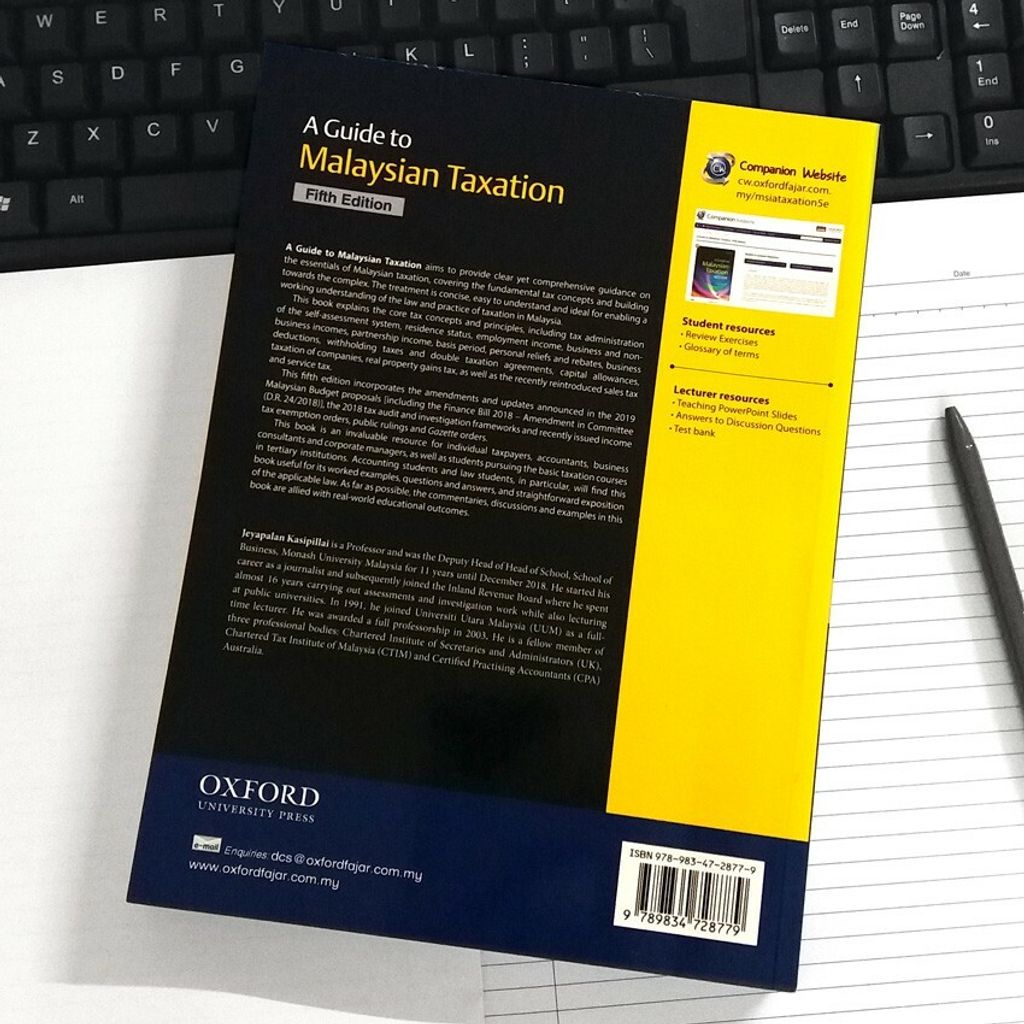

A Guide to Malaysian Taxation 5th edition by Jeyapalan Kasipillai

- Regular price

- RM 99.00

- Sale price

- RM 99.00

- Regular price

-

RM 0.00

Worldwide shipping

Secure payments

Authentic products

Share

* We provide shipping in Malaysia only (West & East).

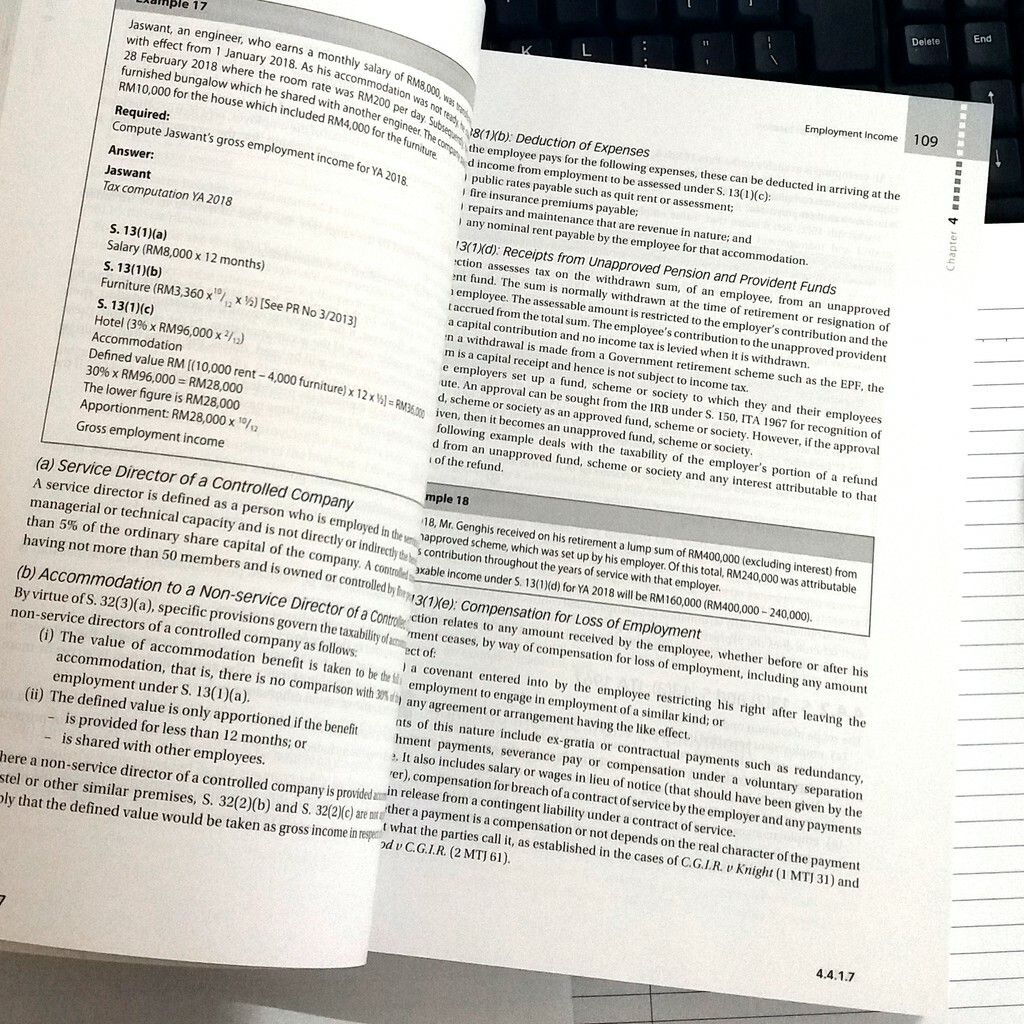

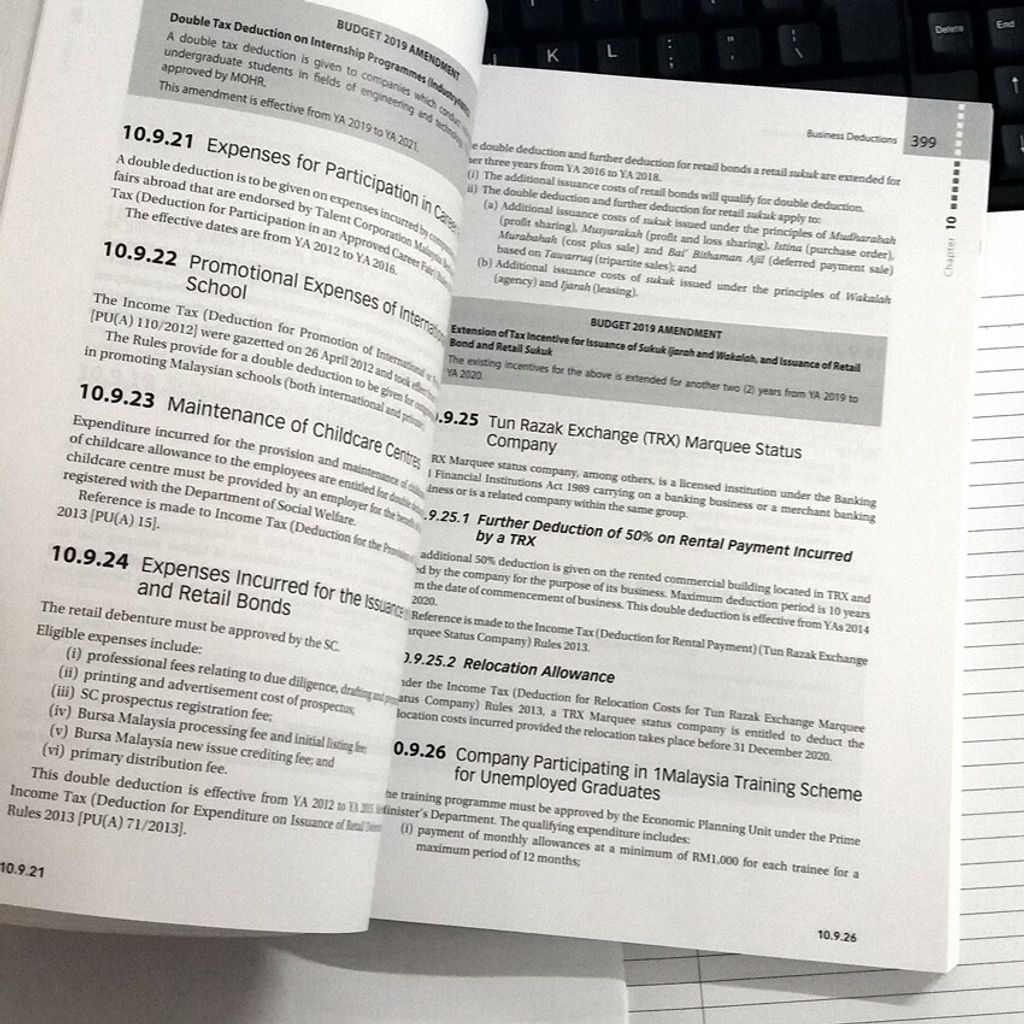

This publication provides a concise yet comprehensive guidance on the essentials of Malaysian taxation to enable a working understanding of the law and practice of taxation in Malaysia. It explains the core tax concepts and principles, including tax administration of self-assessment system, residence status, employment income, business and non-business incomes, partnership income, basis period, personal reliefs and rebates, business deductions, withholding taxes and double taxation agreements, capital allowances, taxation of companies, real property gains tax, as well as the recently reintroduced sales and service tax.

This publication provides a concise yet comprehensive guidance on the essentials of Malaysian taxation to enable a working understanding of the law and practice of taxation in Malaysia. It explains the core tax concepts and principles, including tax administration of self-assessment system, residence status, employment income, business and non-business incomes, partnership income, basis period, personal reliefs and rebates, business deductions, withholding taxes and double taxation agreements, capital allowances, taxation of companies, real property gains tax, as well as the recently reintroduced sales and service tax.

×